Taxation

Basics

Components of salary:

- Basic

- Bonus

- Allowances

- Perquisites

- Leave Encashment

- Gratuity & Superannuation

House Rent Allowance

- Amount exempt under HRA is lower of actual HRA received and 40-50% of basic + DA (depending on the city) and rent paid less 10% of salary.

- You can pay rent to parents and claim exemption for HRA.

- Cannot pay rent to spouse and claim exemption.

- 70% of rent received by parent will be taxed as income.

Leave Travel Allowance

- Actual domestic travel can be claimed twice in a block of 4 years.

- Only travel in public transport can be claimed for self, spouse, parents and children

- Only expenses on travel can be claimed. Food, sight seeing and other expenses cannot be claimed.

- Current block is from 2018-21.

- If LTA is not used in a block, it can be claimed in the immediate year succeeding the block year. (currently till 2022).

- Income from house property

- Dividend Income

- Interest Income

- Gifts

Value to be considered is highest of:

- Rent received

- Fair Market Value (this is the assumed rental value of the property depending on the rental value of similar properties)

- Municipal Value

- Value of the property as perceived by municipal authorities

Deductions Allowed:

- Municipal Taxes

- Interest on loan

- Standard Deduction – 30% of (Rent received – Municipal taxes)

- Cash gifts less than Rs 50,000 received from relatives – exempt from tax

- Gift of immovable property with stamp duty less than Rs 50,000/- – Exempt from tax

- Gift of movable property with fair value of property less than Rs 50,000/- – Exempt from tax

- Aggregate value of gift from employer less than Rs 5000/- – Exempt from tax

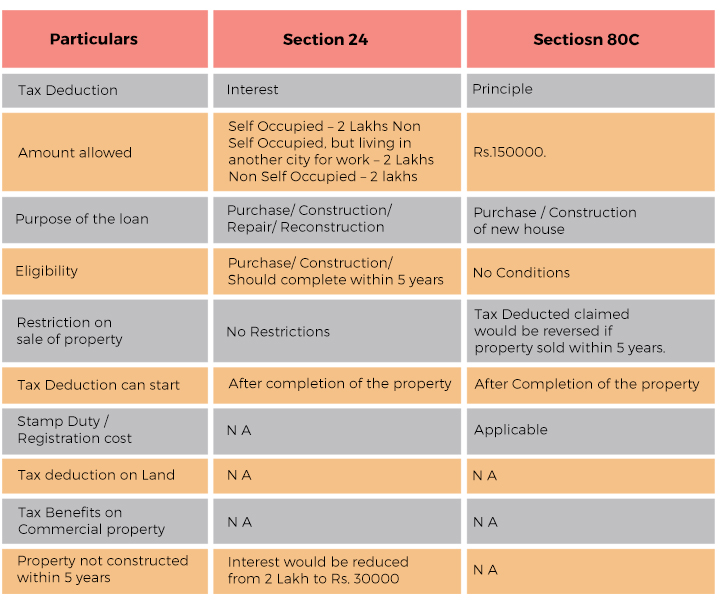

- Section 80C

- Section 80CCD

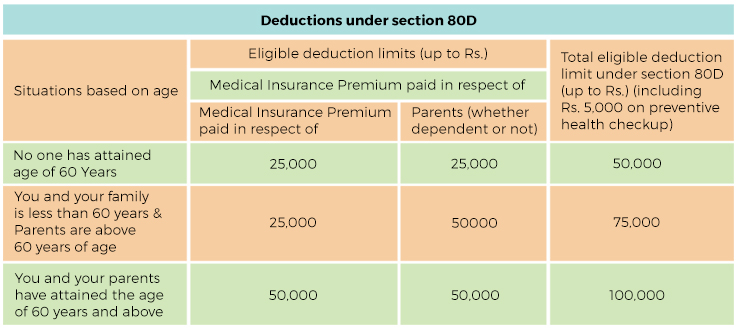

- Section 80D

- Section E

- Section 80G

- Section 80TTA

- Section 24

- EPF / VPF

- PPF

- SSY

- NSC

- Tax Saving FD

- ELSS

- Insurance Premium

- NPS

- Repayment of Home Loan Principle

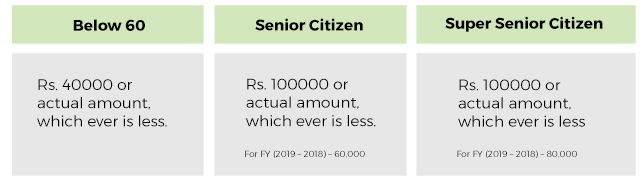

- Tax deduction up to Rs 100,000 for medical insurance premium

Section 80DD

Disabilities covered are:

- Blindness

- Low vision

- Leprosy-cured

- Loco motor disability

- Hearing impairment

Who are qualified?

- For Individuals, disabled dependent can be spouse, children, parents and siblings.

- For HUFs, a disabled dependent can be any member of the HUF

Dependent person with disability :

- Dependent with 40% of disability

- Tax deductions of Rs. 75000

Dependent person with severe disability :

- Dependent with 80% of disability

- Tax deductions of Rs. 125000

cover specific ailments :

- Neurological diseases with 40% or more disability.

- Malignant cancers

- AIDS

- Chronic Renal Failure

- Hematological disorders

Who are qualified?

- For Individuals, disabled dependent can be spouse, children, parents and siblings.

- For HUFs, a disabled dependent can be any member of the HUF

- Section 80 E

- Interest paid on loan taken for higher studies is fully deductible

- Max period to claim deduction is 8 years

- Section 80 G

- Donations

- Section 80 TTA

- Deduction of Rs. 10,000 for interest income earned on savings accounts

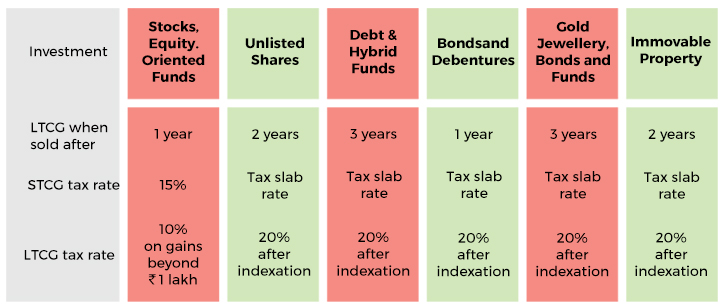

A gain from the sale of a capital asset

- Capital Assets :

–Property

–Gold

–Shares

- Capital gains takes into account the inflation and adds it to the cost

Property:

Sec 54; Exemption from capital gains:

- If the capital gains from sale of house property are reinvested into another property

- One year before the sale or within

2 years of the sale - Gains can be invested in construction

of property provided construction is completed in 3 years - Exemption will be taken back if new property is sold within 3 years of purchase or completion.

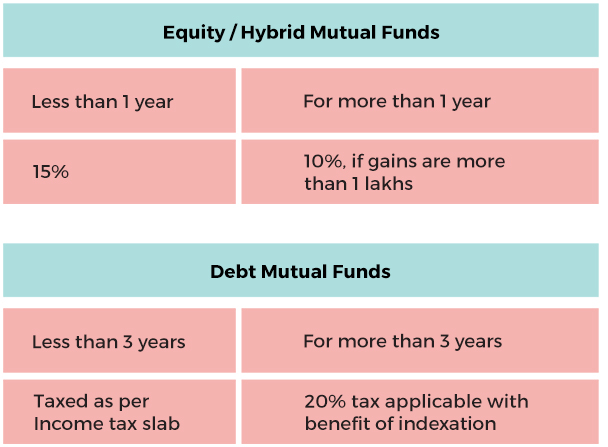

- Short Term and Long Term Capital Gains

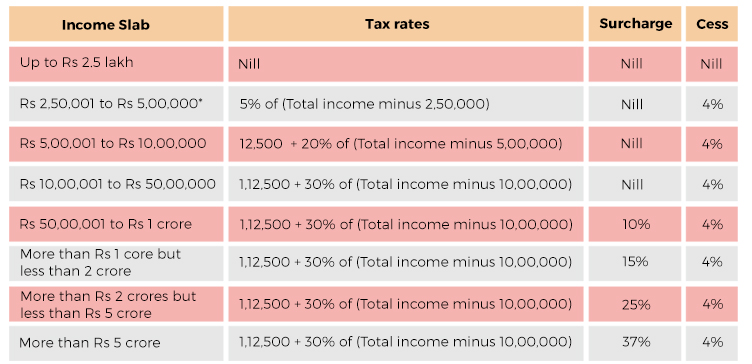

Income Tax Slab Rates for Assessment Year 2020-21

For Individual or HUF or Association of Person or Body of Individual or Artificial Juridical Person

Slab Rates for A.Y. 2020-21 (F.Y. 2019-20) – For individual below age 60 years.

*Rebate up to Rs 12,500 is available for those whose net taxable income does not exceed Rs 5 lakh, thereby resulting in zero tax liability.

- Form 16

- Tax deducted at source from salary

- PART A & PART B

- Form 26AS

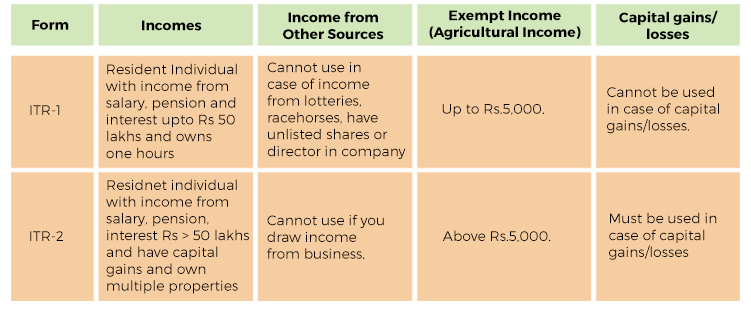

- ITR – 1 to be used for tax filing

- ITR – 2 to be used for tax filing

- Form 16 is a certificate issued under section 203 of the IT Act for tax deducted at source from salary.

- It is also known as a Salary Certificate since

- It contains complete details of salary paid by the employer and its components as well as tax deducted from salary.

- Issued by the employer.

- Form 16 is divided into Part A & Part B.

Part A

- Part A is the certificate of TDS. Contains PAN number, TAN number, name and address of employer and PAN number of employee. It contains a summary of tax deducted and deposited quarterly, which is certified by the employer.

Part B

Part B is annexure containing details of salary paid, other income, tax due and tax paid. This is a complete detailed record of salary and related deductions and exemptions computed in a step by step manner.

- Contact Details to be provided

- ITR 1 is now in sync with columns of Form 16. Now individual must mention gross salary, then amount of exempt allowances, perquisites and profits in lieu of salary to be deducted to arrive at taxable income.

–Separate reporting of all deductions under Sec 16, like standard deduction, entertainment allowance, professional tax

- Income from other sources

–Details on interest income, income tax refund

- House Income :

– mandatory to mention whether it is self-occupied, let out or deemed to let-out.

–PAN of the tenant to be provided in case rent> Rs 50,000 per month & TDS is being deducted

- Capital gains:

– Immovable property- mandatory to furnish details of buyer including name, PAN number, %age share, amount.

–Details of capital gains/losses from equities

- Residential Status :

–Information with respect to tax status needs to be provided like number of days stayed in India, jurisdiction of residence

- Foreign assets:

– Foreign bank details, depository account, foreign debt, equity , insurance contract and cash

- Donations :

–Amount of donation made in cash/other methods to charitable institutions to be given

ITR 1 (Sahaj)

- Furnish details of exempt income like HRA and specify nature of income from other sources.

- Field for standard deduction and exemption on interest from bank and post office deposits under Section 80TTB introduced.

ITR 2

- Detailed information on number of days spent in and out of India to determine residential status.

- Disclosure of information on unlisted shares.

- Disclosure of house buyers, details in case you have sold a property.

- Furnish details related to agricultural income including ownership, size, location and address and status on irrigation.

- For 2017-18 : Taxes cannot be filed unless IT dept sends notice & can be prosecuted

- Late filing but paid taxes: no interest

- Late Filing but outstanding tax liability:

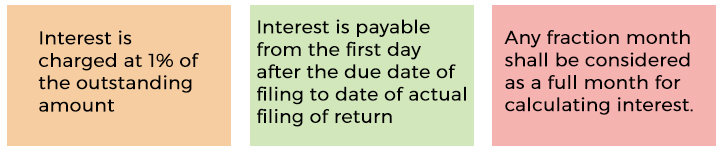

Interest is payable u/s 234A:

- After calculation of income tax, if excess tax has been paid, you can claim a refund

- It can be claimed at the time of filing returns

- Tax refund takes approximately 2-6 months

- Can claim refund only up to previous financial year

- loss of income;

- loss of business profits or contracts;

- business interruption;

- loss of the use of money or anticipated savings

- loss of information

- loss of opportunity, goodwill or reputation;

- loss of, damage to or corruption of data; or any indirect or consequential loss or damage of any kind howsoever arising and whether caused

© Finsafe 2024