PENSION SCHEMES

Basics

- Pension plans or retirement plans are insurance investment products into which you can put money to accumulate over a period of time.

- On maturity, these plans help you have a steady flow of income which can be used for retirement

- Retirement has two phases – accumulation phase and Distribution (vesting) phase

- Accumulation phase is the period where you pay premiums until you reach retirement age and accumulate the amount required for post-retirement needs.

- Distribution or vesting phase is where the accumulated corpus is distributed as annuities in order to take care of post retirement needs.

- Entire accumulated corpus cannot be withdrawn during retirement. Only one-third of the accumulated corpus can be withdrawn and the rest have to be taken as annuities which are nothing but monthly payouts.

- Option in investment: Option to invest either in safe government securities or take some risk and invest in debt and equity investments based on risk profile

- Long term savings

- You can choose how you get paid: Option to either invest lumpsum amount and get annuity payments right away or choose a deferred annuity plan so that corpus earns more interest till payouts begin

- Works as a life insurance cover

- Negates effect of inflation

- Access to lumpsum amount during an emergency

- Limited amount of deduction allowed

– Maximum amount allowed is Rs 1 lakh

- Annuity received after retirement are taxable

- Higher returns require higher risk taking

- Best suited for early investors or investors who start early

Contributions made to pension plans are exempt from tax under Section 80CCC up to a maximum ceiling of Rs 1 lakh.

Only one third of the corpus that is distributed to the retiree soon after reaching the retirement age is tax free.

The rest of the amount that is distributed in the form of annuities is taxable at the tax rate applicable at the time of retirement.

- Traditional pension plans that are sponsored by an insurer invests purely in debt and are meant for conservative investors

- Unit linked pension plans which invest in both equity and debt. The investor can choose the investment mix on his own

- Pension plans sponsored by a mutual fund which are government approved provide a balanced investment approach. They invest in both equity and debt in a proportion of 40:60

- National Pension Scheme: The NPS can invest in either of these fund options: maximum 50% equity, 100% government securities, 100% debt other than government securities

- Created through contributions made by an employee and employer

- Contribution by employer is 12% of basic wages

- Employee will get the money at retirement, can transfer the EPF money in case of switching jobs

- Contributions made by employee is eligible for tax deductions under Sec 80C

- Interest earned on total investments and withdrawals are exempt from tax

- UAN or Universal Account Number is allocated to each individual and can be used to manage EPF accounts and PF withdrawals and transfers

- Withdrawing PF balance without completing 5 continuous years of service has tax implications

- Covers every establishment where 20 or more persons are employed

- Maturity period of 15 years

- PPF enjoys the benefit of EEE status (exempt-exempt-exempt)

- Under Section 80C, contributions up to Rs 1.5 lakhs in a financial year qualifies for income tax deduction

- The interest earned and maturity proceeds are also tax free

- PPF account can be closed after the expiry of 15 financial years from the end of the year in which the account was opened

- The subscriber can retain his/her PPF account after maturity without making any further deposits for any period without limit

- The balance in the account will continue to earn interest till it is closed

- The subscriber can make one withdrawal of any amount in each financial year.

- Further contributions after the PPF account matures, it can be made and extended in blocks of five years.

- There is no limit on the number of times you can extend the PPF account.

- If the PPF account holder wants to continue with the contribution-mode after maturity, he/she has to submit Form H within one year from the date of maturity of the account.

- If the subscriber fails to submit Form H but continues to make deposits in the account, the fresh deposits into PPF account will not earn any interest. They will also not qualify for deduction under Section 80C.

- In case the person has opted to extend his account by a block of five years, during each block period he/she can make one withdrawal not exceeding 60% of the balance at the commencement of each block. This amount can be withdrawn either in one installment (one year) or in more than one installment in different years, not exceeding one withdrawal in a year.

- It is a voluntary fund contribution by the employee towards his EPF account

- Beyond the 12% mandatory contribution

- Maximum contribution is up to 100% of basic salary and dearness allowance

- Only employee contribution is allowed.

- Interest earned at the same rate as EPF

- Once the contribution in VPF is chosen, it cannot be discontinued before a tenure of 5 years is completed

- Contributions to VPF are exempt from tax, also principal and interest on withdrawal are exempt from tax

- Voluntary retirement scheme set up by the government through which one can save for his pension/ retirement corpus

- Mandatory for government employees

- Managed by PFRDA (Pension Fund Regulatory and Development Authority)

- Minimum and maximum age criteria to join NPS is 18 and 65 years

- Contributions to existing NPS account can be made till the age of 70 years

- Employee’s contributions to NPS – upto 10% of basic + DA provides tax benefit in the form of deduction under Sec 80CCD (1)

- 60% corpus can be withdrawn at maturity and the remaining 40% has to be compulsorily used to buy annuities from a PFRDA listed insurance company

- Returns from the annuities are not tax free

- Fund managers of NPS can take exposure to equity and equity related instruments

Tier I account:

- It is a mandatory account.

- Only 20% contributions can be withdrawn before the age of 60 years.

- Remaining 80% has to compulsorily be used to buy annuity from a life insurer.

- After attaining the age of 60, close to 60% contribution can be withdrawn tax free and the remaining 40% need to be used to purchase annuity from approved life insurer.

Tier II Account:

- Voluntary savings option.

- No limit on amount that can be withdrawn.

- 25% of Tier 1 contribution can be withdrawn tax-free.

- Individual should be in NPS for 3 years.

- Withdrawal for specific purposes.

- Max 3 withdrawals allowed.

Active Choice:

- This option allows investor to choose how money should be invested in different assets

- Active choice offers 3 investment options:

- a) Asset Class E – invests in equity and related instruments

- b) Asset Class C – invests in fixed income instruments other than government securities

- c) Asset Class G – invests only in government securities

- d) Asset Class A – invests in Alternate Investment funds like CMBS, MBS, REIT, etc.

Subscriber can select multiple asset classes with below mentioned conditons:

Upto the age of 50 – Maximum permitted equity allocation in 75% of the total asset allocation.

From 51 years and above – maximum equity allocation will be as per equity allocation matrix given below.

Percentage contribution value can not exceed 5% for Alternate Investment Funds.

Total Allocation across asset classes A, C, G and A must be equal to 100%.

| Age (in years) | Maximum Equity Allocation |

| Upto 50 | 75% |

| 51 | 72.50% |

| 52 | 70% |

| 53 | 67.50% |

| 54 | 65% |

| 55 | 62.50% |

| 56 | 60% |

| 57 | 57.50% |

| 58 | 55% |

| 59 | 52.50% |

| 60 & above | 50% |

Auto choice or lifecycle fund:

Default option which invests money automatically in line with the age of the subscriber. The proportion of funds invested across the asset classes will be determined by a pre-defined portfolio based on the age of the subscriber. As age increases, exposure to equity and corporate debt tends to decrease.

Depending on the risk appetite of the subscriber, there are 3 options available in Auto choice option – Aggressive, Moderate and Conservative.

- a) Aggressive Life Cycle Fund: Provides a cap of 75% of the total assets for equity investment. The exposure in equity starts with 75% till the age of 35 and gradually decreases as per the age of the subscriber.

| Age (in years) | Asset Class E | Asset Class C | Asset Class G |

| Upto 35 | 75 | 10 | 15 |

| 36 | 71 | 11 | 18 |

| 37 | 67 | 12 | 21 |

| 38 | 63 | 13 | 24 |

| 39 | 59 | 14 | 27 |

| 40 | 55 | 15 | 30 |

| 41 | 51 | 16 | 33 |

| 42 | 47 | 17 | 36 |

| 43 | 43 | 18 | 39 |

| 44 | 39 | 19 | 42 |

| 45 | 35 | 20 | 45 |

| 46 | 32 | 20 | 48 |

| 47 | 29 | 20 | 51 |

| 48 | 26 | 20 | 54 |

| 49 | 23 | 20 | 57 |

| 50 | 20 | 20 | 60 |

| 51 | 19 | 18 | 63 |

| 52 | 18 | 16 | 66 |

| 53 | 17 | 14 | 69 |

| 54 | 16 | 12 | 72 |

| 55 & above | 15 | 10 | 75 |

Moderate Life Cycle Fund: Provides a cap of 50% of the total assets for equity investment. The exposure in equity starts with 50% till the age of 35 and gradually decreases as per the age of the subscriber.

| Age (in years) | Asset Class E | Asset Class C | Asset Class G |

| Upto 35 | 50 | 30 | 20 |

| 36 | 48 | 29 | 23 |

| 37 | 46 | 28 | 26 |

| 38 | 44 | 27 | 29 |

| 39 | 42 | 26 | 32 |

| 40 | 40 | 25 | 35 |

| 41 | 38 | 24 | 38 |

| 42 | 36 | 23 | 41 |

| 43 | 34 | 22 | 44 |

| 44 | 32 | 21 | 47 |

| 45 | 30 | 20 | 50 |

| 46 | 28 | 19 | 53 |

| 47 | 26 | 18 | 56 |

| 48 | 24 | 17 | 59 |

| 49 | 22 | 16 | 62 |

| 50 | 20 | 15 | 65 |

| 51 | 18 | 14 | 68 |

| 52 | 16 | 13 | 71 |

| 53 | 14 | 12 | 74 |

| 54 | 12 | 11 | 77 |

| 55 & above | 10 | 10 | 80 |

Conservative Life Cycle Fund: Provides a cap of 25% of the total assets for equity investment. The exposure in equity starts with 25% till the age of 35 and gradually decreases as per the age of the subscriber.

| Age (in years) | Asset Class E | Asset Class C | Asset Class G |

| Upto 35 | 25 | 45 | 30 |

| 36 | 24 | 43 | 33 |

| 37 | 23 | 41 | 36 |

| 38 | 22 | 39 | 39 |

| 39 | 21 | 37 | 42 |

| 40 | 20 | 35 | 45 |

| 41 | 19 | 33 | 48 |

| 42 | 18 | 31 | 51 |

| 43 | 17 | 29 | 54 |

| 44 | 16 | 27 | 57 |

| 45 | 15 | 25 | 60 |

| 46 | 14 | 23 | 63 |

| 47 | 13 | 21 | 66 |

| 48 | 12 | 19 | 69 |

| 49 | 11 | 17 | 72 |

| 50 | 10 | 15 | 75 |

| 51 | 9 | 13 | 78 |

| 52 | 8 | 11 | 81 |

| 53 | 7 | 9 | 84 |

| 54 | 6 | 7 | 87 |

| 55 & above | 5 | 5 | 90 |

| Particulars | PPF | EPF/ VPF | NPS |

| Returns ( % p.a) | 7.1 | 8.25 ( as per EPF) | 5-7 |

| Guaranteed returns | Yes | Yes | Market Linked |

| Time frame | 15 years | Till Retirement | Upto 60 years of age |

| Tax | Nil | Nil | Partially taxable |

| Risk | Low | Low | Medium |

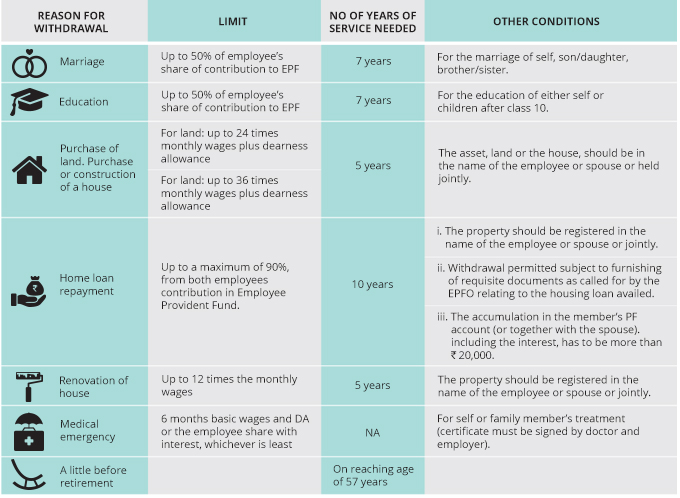

| Reasons for Withdrawal | Withdrawal Limit | Eligibility |

| Medical purposes (self, spouse, children, or parents) | 1. Six times the monthly basic salary, or | No criteria |

| 2. The total employee’s share plus interest. | ||

| Marriage (self, child, siblings) | Up to 50% of employee’s share of contribution to EPF | After 7 years of employment |

| Higher education (self or child) | Up to 50% of employee’s share of contribution to EPF | After 7 years of employment |

| Construction or purchase of a house/land | Up to 24 times for land & up to 36 times for house of the monthly basic salary + dearness allowance. | After 5 years of employment |

| Home loan repayment | 90% of PF accumulations | After 10 years of employment |

| House renovation | Up to 12 times the monthly wage | After 5 years of employment |

| Partial withdrawal before retirement | Up to 90% of the total accumulated balance, given the employee is above 54 years of age | 1 year before retirement |

| Type of withdrawal | Withdrawal Limit (Amount) | Eligibility |

| Partial Withdrawal | 50% of total available balance | After 6 years from account opening |

| Premature closing of account | Full amount but only for medical or educational purposes | After 5 years from account opening |

| Type of withdrawal | Withdrawal Limit (Amount) | Reason for Withdrawal | Eligibility |

| Partial Withdrawal | Up to 25% of self contribution to Tier 1 NPS account | Only for specific reasons like medical emergency, child higher education, marriage expenses, renovation of house, etc. | After 3 years from account opening Can be done 3 times in entire NPS tenure Minimum 5 years gap between 2 consecutive partial withdrawals except in case of medical emergency |

| Premature closing of account | 20% of corpus or (2.5 lakhs if stayed invested for more than 10 years) Remaining 80% of corpus to be invested into annuities | Any reason | After 5 years from account opening |

| Complete withdrawal | 60% of corpus or full amount if corpus is less than 2.5 lakhs | Maturity | After the age of 60 Can be taken as a lumpsum or in installments till the age of 75 |

- loss of income;

- loss of business profits or contracts;

- business interruption;

- loss of the use of money or anticipated savings

- loss of information

- loss of opportunity, goodwill or reputation;

- loss of, damage to or corruption of data; or any indirect or consequential loss or damage of any kind howsoever arising and whether caused

© Finsafe 2024