mutual funds

Basics

A mutual fund is a professionally managed trust, which pools the investors’ money and invests them into stocks, bonds, commodities, money market instruments and other securities. A mutual fund is like a basket of investments and your investment in the fund is a part of that basket.

The value of the mutual fund company depends on the performance of the securities it decides to buy. So when you buy a share of a mutual fund, you are actually buying the performance of its portfolio.

Diversification

Diversification reduces risk. Instead of buying shares, bonds, and other investments on your own. Mutual Fund invests in assets on your behalf. This helps in reducing volatility.

Professional Management

The advantage of mutual funds is that they are managed by professional experts ( fund managers and research analysts). They will invest your money to buy and sell stocks after much research.

Simplicity

It is very easy to invest in mutual funds. There are online options available as well.

Liquidity

Mutual funds are highly liquid. You can, therefore, withdraw the money when were needed and based on the asset class the money will be transferred in a minimum of 1 day or 3 days.

Can invest with small amounts

As low as Rs 500 or Rs 1000. Unlike other investments like real estate or stocks, mutual funds allow you to start as small as Rs 1000.per month.

Automated Investment

The Systematic Investment Plan or SIP helps you automate your investments.

Safe and transparent

All mutual fund companies come under the purview of SEBI and they need to make necessary disclosures.

Sponsor – As per SEBI regulations, a sponsor is a person or a combination with another corporate, who forms a mutual fund or gets the mutual fund registered.

Trustee – The sponsors form a trust and appoint a board of trustees through a Trust Deed. The trustees monitor the activities of the mutual fund and ensure that they comply to SEBI guidelines. The trustees have to report to SEBI every six months about the activities of the AMC.

Asset Management Company – Appointed by trustees for managing the mutual fund schemes. Works under supervision of its Board of Directors, trustees and SEBI.

Fund Manager – Manages the portfolio of the mutual fund schemes. Responsible for complying with the regulatory authorities and to protect the wealth and monitor the growth and performance of the fund.

Registrar – Are the operational arm of the Mutual Funds or provide back end support to mutual funds in terms of processing investors application, keeping a record of their details, sending out account statements and periodic reports to investors, processing payout of dividends, etc.

NAV is the total asset value (net of expenses) per unit of the fund.The final value of all the securities held in the portfolio is calculated daily, from this expenses are deducted.

- NAV: Is used to calculate the number of units an investor can purchase or redeem in a scheme

- The market value changes every day and this is reflected in the NAV of the scheme.

To check the performance of the scheme. While comparing two schemes, one must calculate the % increase in NAV and not the increase in the absolute amount

Expense ratio is the percentage of total assets that are spent to run a mutual fund like administrative expenses, salaries, advertising expenses, brokerage fee, etc. A 1.5% expense ratio means the AMC charges Rs1.50 for every Rs100 in assets under management.

A fund’s expense ratio is typically to the size of the funds under management and not to the returns earned. The more assets in the fund, the lower should be its expense ratio.

Portfolio transaction fees, or brokerage costs, as well as initial or deferred sales charges are not included in the expense ratio.

Some AMCs have sales charges, or loads, on their funds (entry load and/or exit load) to compensate for distribution costs. Funds that can be purchased without a sales charge are called no-load funds.

- Entry load is the amount charged from an investor while entering a scheme or joining the company as an investor.

- Generally, an entry load is collected to cover distribution costs of the company. In India, the entry load was usually about 2.25% of the value of investment. As per mandate from SEBI, since August 2009, mutual funds do not charge any entry load from the investors.

- An exit load is the amount charged from an investor for exiting or leaving a scheme or the company as an investor.

- The motive of collecting exit load is to discourage investors from exiting the mutual fund scheme. Different mutual funds houses charge different fees as exit load.

- Exit load in equity schemes is generally 1% if redeemed within one year from the date of investing.

- Exit load on debt fund varies from 0 to 2% and minimum investment varies from 6 months to 2 years.

All Mutual Funds in India offer two options to invest in the schemes:

- Direct Plan

- Regular Plan

Direct Plan and Regular Plan was introduced by SEBI in 2013.

- Mutual fund direct plans are those where mutual fund houses do not charge distributor expenses / trail fees / transaction charges.

- There would be a separate NAV (Net asset value) for direct plans and regular plan. NAV of the direct plan would be higher compared to a regular plan.

- The investment objective and investment mix of the scheme portfolio would be same for direct or regular plans.

- Direct Plan expense ratio would be lower as compared to regular plans.

Mutual funds provide the following options is every scheme:

Growth Option

- Under the growth option you get units at the time of purchase and you have same number of units till the end. The NAV keeps changing according to performance.

Dividend Option

- Part of the profits made is paid back as dividend and the Net Asset Value (NAV) of the scheme will fall to the extent of dividend declared.

Dividend Reinvestment Option

- The dividend paid out is reinvested back into the scheme.

There are broadly 3 categories of funds available

Open Ended Fund

- Investors can buy/sell units at any point of time.

Closed Ended Fund

- Units can be purchased only during New Fund Offer (NFO) & has a stipulated maturity period. Investors may be able to exit the fund but with a penalty.

Interval Funds

- which are largely close ended but become open ended at pre-specified intervals. During these periods, the investor may be allowed to exit the fund.

Depending upon the investment horizon, there are various types of debt funds available:

Liquid Funds or money market funds

- These funds help to provide liquidity, preservation of capital and moderate income. These schemes invest into shorter and safer bonds like Treasury-bills, Certificate of deposit and other money market instruments. Returns on these schemes are generally not volatile and these funds can be used to park surplus funds for short periods ranging from 1 day to 3 months.

Ultra Short Term Funds

- These funds invest in bonds with short-term maturity dates and can be used to park surpluses between 3 months to 6 months

Low Duration Funds

- Invest in short term bonds and can be used to park funds for 6-12 months

Short Term Funds

- These funds invest predominantly in debt securities like corporate bonds for medium term maturities and are suitable for investing for 3 years investment horizon.

Corporate Bond/credit risk Funds

- invest in corporate bonds with a portion being invested in bonds with a lower credit rating and can generate a higher return than a short term fund. These funds are suitable to invest for period > 3 years.

- Corporrate bonds have a minimum of 80% in highest rated instruments

- Credit Risk Funds can have more than 65% in lower rated instruments

Medium & Long Duration Funds

- Invests in corporate bonds and government securities with longer maturity. These are suitable for investors who have longer time horizon(4-10 years) and can accept volatility as returns are directly affected by the interest rates.

Gilt Funds

- invest in government securities which do not have any default risk and have a minimum of 80% invested in Gilts. Gilt funds carry interest rate risk and are suitable for investors with over 3 year investment horizon and who can accept volatility.

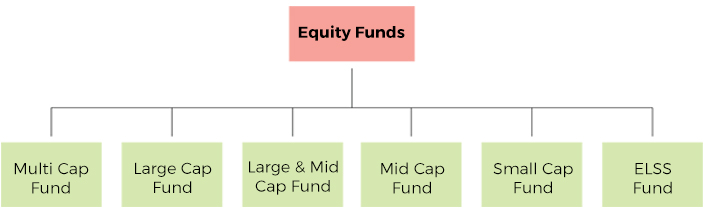

These funds invest in shares of companies and provide capital appreciation over a long term period. Equity funds are suitable for investors with investment horizon above 7 years as in the short term these funds could be very volatile. Equity Funds are subject to market risk which is the prices of the stocks in which the fund has invested could go up or go down.

Equity Funds

By the size of stocks

Large Cap Fund

Invest a minimum of 80% in Large sized companies across various sectors.

Large & Mid Cap Funds

Funds which invest in a combination of large and medium sized companies across various sectors. They invest a minimum of 35% in large size companies and a minimum of 35% in medium sized companies.

Multi Cap Funds

Invest in a combination of large, medium and small sized companies across sectors and have a minimum of 65% in equities. These funds help minimize the risk of overconcentration of investments in few stocks.

Mid Cap Funds

Invest a minimum of 65% in medium sized companies. These funds are more volatile than multicap funds.

Small Cap Funds

Invest a minimum of 65% in Small sized companies across various sectors. These funds are more volatile than Multi Cap, Large Cap and Mid Cap Funds.

ELSS – Tax Saving Funds

ELSS : is an equity fund which offers tax benefits under sec 80C of the Income Tax Act. The minimum lock in period is 3 years. These funds provide the dual advantage of tax savings and growth.

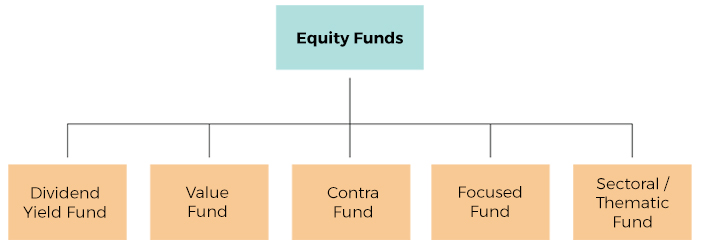

Dividend Yield Fund

Invests a minimum of 65% of total assets in equity and predominantly invests in dividend yielding stocks.

Value Fund

Invests a minimum of 65% of total assets in equity and scheme follows a value investment strategy, ie. It chooses stocks which are undervalued in price.

Contra Fund

Invests a minimum of 65% of total assets in equity and scheme follows a contrarian investment strategy. The fund manager bets against the prevailing market trends by investing in stocks that are not in favour.

Focused Fund

Invests a minimum of 65% of total assets in equity and has a limited number of stocks (maximum 30). The aim is to deliver a higher return by focusing on a few companies but these funds are typically meant for more aggressive investors as the risks are higher.

Sectoral/Thematic Fund

Invests a minimum of 80% of total assets, in equity of a particular sector like IT, Pharma. They are risky compared to mutlicap funds owing to their concentration in only a single sector.

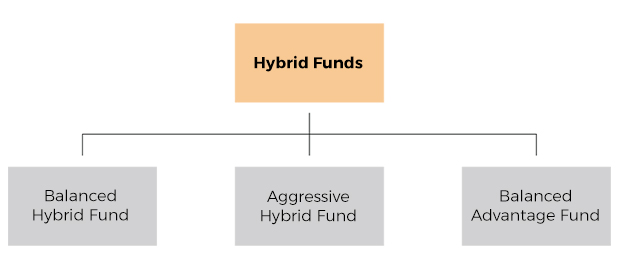

Balanced Hybrid Funds

invest in a combination of stocks and bonds.

A balanced hybrid fund has 40-60% in equities and balance in bonds.

Aggressive Hybrid Fund

A aggressive balanced fund has 65-80% in equities and the remaining in bonds.

Balanced Advantage Fund

Balanced Advantage Fund also known as a Dynamic Asset Allocation Fund invests both in stocks and bonds.

-The allocation into each of these asset classes is not fixed.

-Managed Dynamically.

-Less risky compared to other Balanced Funds.

-Allocation to Bonds or Stocks will change as per Fund Mangers views.

- Right to operate account passes on to the major (new investor)

- To update change in status, application needs to be submitted in prescribed format to mutual fund giving details of folio, new PAN, contact details and new bank details

- KYC formalities need to be completed along with proofs for the same

- A cancelled cheque with name and bank details of investor on it needs to be provided

- Signature of investor attested by bank manager has to be provided for inclusion in mutual fund

- Folio will be updated with new information provided and replace that of the guardian

- All further transactions in the folio can be directly undertaken by the minor who has now become a major

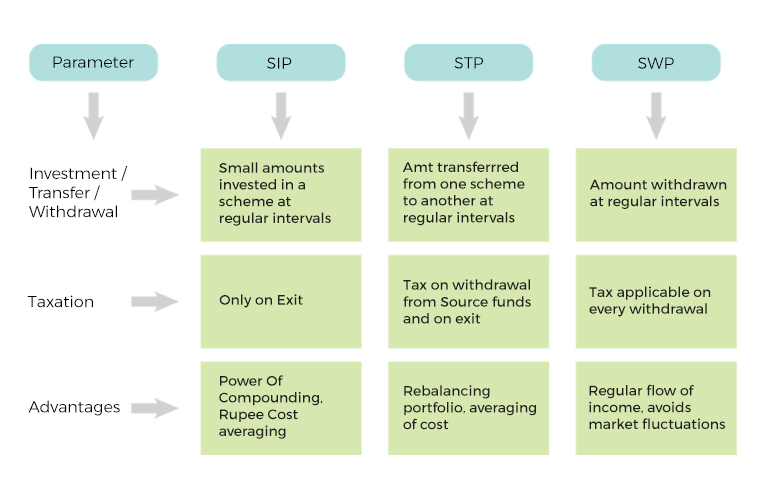

- A Systematic Investment Plan or SIP is a regular investment in a fund for a fixed amount at regular intervals and for a fixed period of time.

- It is similar to investing in a recurring deposit in a bank.

- Inculcates a habit of regular investments (allows you to save before spending)

- Minimum time and effort as you can automate investments

- Can invest with as low as Rs 1000/-

- Rupee Cost Averaging

- Does not time the market

- Over longer term, SIPs can generate better returns than the market

KYC stands for Know Your Customer which is a mandatory step for investors to go through before they start investing in the securities market. Only after an investor is KYC compliant can he start investing.

The mutual fund industry has nominated and authorized CDSL Ventures Limited to conduct the Know Your Customer procedure. To get KYC compliant, you can choose to take the offline route or choose eKYC (online KYC).

Online or eKYC

eKYC is a simpler and faster process to get KYC compliant. All you need are your PAN and Aadhaar nos.

The steps are as follows:

- Enter your PAN and Aadhaar nos.

- Get authenticated with an OTP

- Start investing. Once you are KYC compliant, you can invest in any scheme of any of the fund houses.

Offline:

- Download the KYC application form from the CDSL Ventures website and fill in the details

- Sign and submit a physical copy of the form to the specified authorities or intermediaries through whom you wish to invest in mutual funds

- Attach the photocopies of ID proof, residence proof and a passport size photo along with the form

- You can check your KYC status online. You can go to the official website of CDSL Ventures Limited(www.cvlkra.com) and enter in your PAN number to check if you are KYC compliant or not. If you are, there is no need to do it again.

Investors investing Mutual fund schemes should know how their money is managed. To make it easier for investors, Mutual Fund houses put out disclosures for all underlying schemes, called factsheet.

It contains almost everything you need to know about a mutual fund (MF) scheme; from where it has invested to all its salient features.

Factsheet is disclosed on a monthly basis.

A Scheme Information Document (SID) is something that tells you every detail about your mutual fund scheme.

It is a document that every investor is advised to read before investing in a mutual fund because it is a comprehensive summary of everything that concerns the fund such as the investment objective, risk factors, investment strategy, performance and more.

- Mutual fund investments can be made in the name of minors (below the age of 18)

- Opened on behalf of minor by guardians operating on behalf of minor

- Guardians are either natural guardian (mother, father) or a court appointed guardian

- Application form must be accompanied by supporting documents for proof of date of birth and relationship to minor. In case of guardian, court papers are required to be produced

- Guardian needs to comply with all regulatory formalities like completing KYC, providing PAN and bank details, etc

- Minor will be sole holder in the folio and cannot have a joint holder or nominee

- Payment for investment to be made from guardian’s account or from minor’s account operated by the guardian. Investment from third party including a parent who is not mentioned as guardian will be subject to a limit of Rs 50,000/-

- Guardian may be changed with consent of existing guardian or due to death of existing guardian or to comply with court orders appointing a new guardian for minor’s investment. New guardian needs to register all supporting documents with the mutual fund

- loss of income;

- loss of business profits or contracts;

- business interruption;

- loss of the use of money or anticipated savings

- loss of information

- loss of opportunity, goodwill or reputation;

- loss of, damage to or corruption of data; or any indirect or consequential loss or damage of any kind howsoever arising and whether caused

© Finsafe 2024